Oregon Rep. Cliff Bentz insists Republicans ‘not cutting’ Medicaid, SNAP

Published 2:59 pm Thursday, May 22, 2025

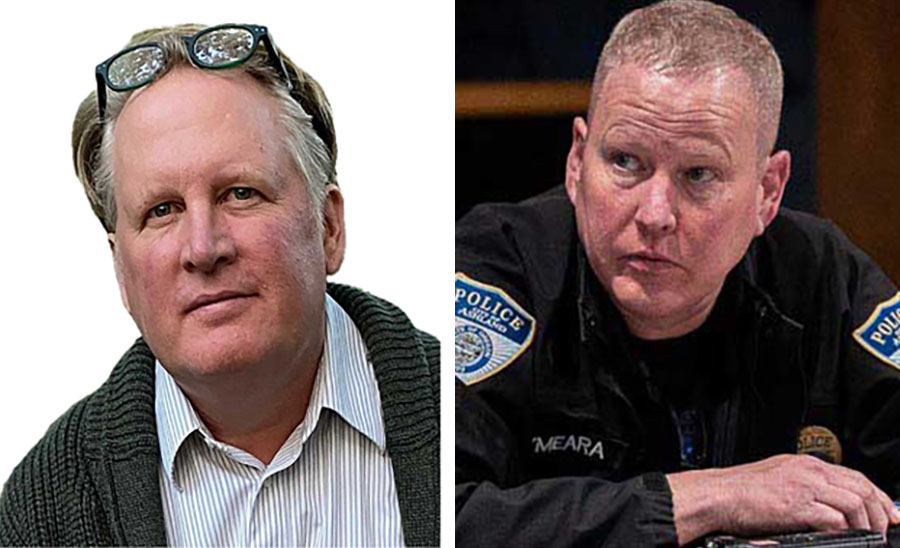

- Rep. Cliff Bentz is Oregon’s sole Republican member of Congress. Malheur Enterprise photo

The 2nd District congressman holds virtual town hall, says he consulted with former Oregon Gov. John Kitzhaber, a Democrat, weekly for input on the Medicaid portion of the Republican budget, but Kitzhaber calls bill’s passage ‘a disaster’

Oregon’s lone Republican representative in Congress defended the party’s decision to attach new work and citizenship requirements to Medicaid eligibility at a virtual town hall Wednesday night and said there is a “travesty” of able-bodied, non-working Americans.

U.S. Rep. Cliff Bentz, who represents Oregon’s 2nd Congressional District covering much of eastern Oregon, answered fewer than a dozen questions submitted online or over the phone during the hourlong event. Bentz said he chose to meet with constituents virtually so that he could reach more of them at once, and because some in the crowd at his in-person town halls earlier in the year were “borderline abusive.”

Bentz started off by explaining what he sees as wins in the Republican budget proposal, which passed the U.S. House of Representatives early Thursday morning. Bentz said he personally worked on much of the 1,100-page bill.

The wins, he said, include income tax cuts and ending taxes on social security benefits; more federal spending on border walls, Immigration and Customs Enforcement, increasing wages and bonuses for Immigration and Customs Enforcement officers, ending tax incentives under the Inflation Reduction Act that “let climate activists set the standards for American energy” and what he said was President Donald Trump’s plan to “completely overhaul” air traffic control systems in the U.S.

But the most common theme among the questions posed by constituents related to the bill was about the fate of the Supplemental Nutrition Assistance Program, or SNAP, which helps low-income people and families afford food, and Medicaid, which funds healthcare for low-income people, kids in low-income families and some people with disabilities.

One in three Oregonians is covered by Medicaid through the Oregon Health Plan, including half of all kids in the state and 70% of kids in Bentz’s district. More than 730,000 Oregonians rely on SNAP.

‘Working or not’

The bill passed by U.S. House Republicans would lead to $300 billion in cuts to SNAP, according to the left-leaning Center on Budget and Policy Priorities, and $625 billion of federal funding cuts for Medicaid over 10 years, under the latest estimate by the Congressional Budget Office.

Medicaid cuts would be done in part by requiring those who rely on the state-federal health program and who are between the ages of 19 and 65, to work, participate in community service or attend an educational program at least 80 hours a month. It would also strip Medicaid funding that some states, such as Oregon, use to offer the program to people regardless of immigration status.

Bentz told listeners at the beginning of the event that 4.8 million able-bodied adults are receiving Medicaid benefits and choosing not to work, then later claimed that 21 million Americans are “not actively seeking work, even though they’re capable.” Bentz did not cite any sources for these numbers or respond to an email from the Capital Chronicle asking for the source data.

“It’s a travesty the number of folks that are not working in the United States,” Bentz told his online and call-in audience.

One, a retired doctor from Medford, told Bentz he was concerned about the future of rural hospitals — already operating on thin margins — if Medicaid coverage is harder for Oregonians to get. He told Bentz it will leave hospitals and clinics covering the costs when an uninsured patient walks in.

“You know, working in the hospital, if somebody gets sick, regardless of failure to pay, they’re going to be taken care of,” he said. “Working or not, people still get sick.”

In response, Bentz doubled down on the notion that Republicans are not cutting Medicaid, just imposing more requirements to access it.

“I’m not happy when people start saying ‘You’re going to cut Medicaid,’ because that’s not true,” he said. “What we’re doing is imposing an obligation for those who can work, to work.”

Bentz said he frequently consulted with John Kitzhaber, former Democratic Oregon governor and doctor, on the Medicaid portion of the bill, and said Kitzhaber put together a work group for Bentz to correspond with about Medicaid.

“I reached out to him four months ago and said, ‘Hey, I’m on this subcommittee. Would you be so kind as to assist me in better understanding how we can best approach Medicaid?’ And to his credit, he’s worked with me. I’ve spoken to him almost once a week over the past three months,” Bentz said.

Kitzhaber confirmed this on a call with the Capital Chronicle but said the bill that Republicans passed Thursday is “immoral” and called it “a disaster.”

“We advised him on how the program works, and I warned him over and over again that the impact of this was not going to be good, especially for people in his part of the state,” Kitzhaber said.

He took issue with Republicans dangling work requirements for Medicaid as a new and effective cost-saving measure, because they obfuscate from the reality that most people on Medicaid are already working.

“The fact is, most of those people are working. Some of them have reasons for not working. Some of them are enrolled in community colleges around the state, including east of the mountains. It’s a solution looking for a problem and it’s a way to rationalize huge tax breaks for corporations and people at the top of the income scale,” he said.

Kitzhaber said predicating health care coverage on citizenship is particularly cruel.

“I mean, that is a page out of the Trump playbook. It is the politics of blame. It is the politics of hate,” he said.

Beyond benefits

In response to a constituent question about wildfire prevention, Bentz said the Republican spending bill contains a provision that would allow timber companies a 20-year lease in federal forests to “help manage these forests.”

He said any reporting that the Forest Service won’t have the firefighters they need this summer is wrong.

“There’s been some who have been saying that because of reductions by DOGE and others, that somehow we’re not going to have the people to fight the fire. I just want to assure people that the Forest Service reductions have been extremely modest,” he said.

One caller asked Bentz about prescription drug prices rising, telling him a medicine she takes recently went from $11.98 per month to $40 per month.

Bentz said it’s because of drug companies and pharmacy benefit managers, who will be reined in under a provision of the budget bill.

“We have a parcel fix for that in this great big bill,” Bentz said. “I didn’t read it off but it’s there, and it should have some impact in reducing the cost of drugs.” He said Trump’s negotiating strategy to reduce prescription costs — as the president has promised, by 30% to 80% — is to “make foreign countries pay more so we can pay less.”

Bentz said it is likely that Democrats would attack tax cuts in the bill as disproportionately benefiting wealthy Americans. Indeed, the latest report from the Congressional Budget Office found the package tilted benefits toward the wealthy, projecting it would decrease resources for low-income families over the next decade while increasing resources for top earners.

“The primary thing that you’re going to hear from AOC (Democratic Congresswoman Alexandria Ocasio Cortes, representing New York’s 14th District), and every one of my fellow congresspeople from Oregon, because they are all Democrats, would be that this is a tax bill for the wealthy,” he said.

He said the top 1% of Americans pay 40% of the income tax, a popular line among Republicans.

“Wealthy people are paying huge amounts of tax,” he said. “What they don’t pay in tax they invest back in the business.”

The top 1% of Americans pay the larger share of income tax because they receive about half of all taxable income in the U.S. each year, according to analysis from the nonprofit, New York-based Peter G. Peterson Foundation, a centrist policy and research group that supports reducing the national debt and federal spending.

Revenue from income taxes is also just one-half of all the tax revenue the federal government collects each year. When payments for all federal taxes — income tax, payroll tax, business taxes, etc. — are spread across all income groups, analysis shows the top 1% pay 25% of federal taxes while the bottom 80% pay 31% of federal taxes, according to the analysis. The bottom 80% are made up of households earning less than $176,000 per year.

The bulk of income earned by the 1% is not labor income, but income from investments and business, according to the analysis.